Turnaround & Restructuring

Businesses in financial distress (in most cases) does not happen overnight. It is imperative that leadership review their most important asset (available liquidity) regularly to understand trends and discuss downside scenarios before they occur. A significant part of governance (board oversight) is understanding what the business could face and the implications should those events or situations occur. Like any ailment, available options to execute a successful in-court / out-of-court turnaround are highest when potential financial distress is recognized by companies earlier. The terms ‘restructuring’ and ‘turnaround’ are often viewed by company leadership as a failure of management. Regardless of what has led to the potential or actual financial distress, the most important thing a company can do is ask for an outside assessment.

In my experience, I have worked with many companies on these types of assessments and found that the potential financial issues were remediated with tactical changes to their operations to drive improved financial results and confidence with their stakeholders. In other cases, these assessments found that the situation was far more dire than anyone inside the company believed.

The common theme of those who were able to change course without a major turnaround effort were the ones who sought help in the form of a business plan assessment early-on. The ones who waited are the ones who often suffered.

Key Exercises to Evaluate Financial Distress and Effectuate a Turnaround:

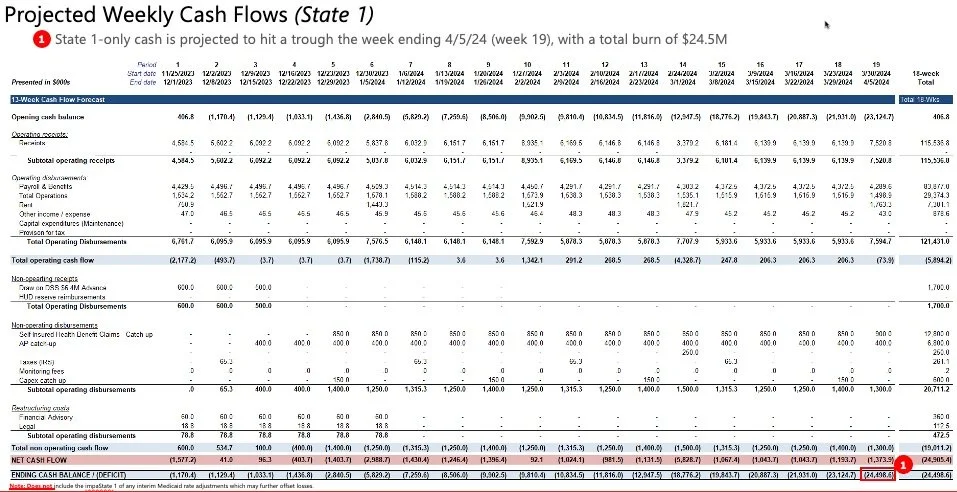

Liquidity Management & Cash Flow Forecasting (13-Week) with Budget-to-Actual variance analyses

Business plan assessment (identification of profitability issues, loss-leaders, underperforming business segments, lack of disciplined processes leading to strategic financial losses, etc.)

P&L vs. Balance Sheet issue: If a company is losing money due to declining sales, that is much different than a company that has stable (or even growing) revenue but still cannot service its debt or fund necessary capital investments.

Management vs. Structural issue: We live during a time when entire industries can be destroyed at a far faster rate than ever before due to technology. Sometimes these paradigm shifts can be foreseen; often times, they cannot. That is a structural issue and much harder to solve for. Management issues such as lack of discipline with liquidity, ongoing investment in loss leader R&D projects, inability to manage working capital to fund operations, are examples of management issues that can be solved much easier - much easier does not mean easy.

Debt Capacity Analysis (are there unencumbered assets that can be used for additional financing, and is there additional amounts of debt service that the company’s current operating cash flow support).

4-Wall Analysis: For businesses with multiple locations, a 4-wall analysis assesses the profitability (or lack thereof) of each location as a standalone business. This does not mean an unprofitable location should be closed, it raises the question of why and how fast it can be fixed (?)

Restructuring Plans for Lenders (Savings Initiatives / Monetization of Assets / Business Plan Calibration): Engaging with stakeholders such as lenders and landlords (if a real estate intensive business) early-on is essential - it buys credibility and regardless of your current relationship with your lenders, it can only enhance trust and transparency. No lender ever wants to walk into a loan in their portfolio when there are no options left.

Implications of tariffs including the evaluation of pulling forward planned inventory purchases, evaluating alternative sourcing strategies and understanding the revenue impact of passing-on tariffs in-part or in-full to end customers.

Case Study

Northeast-based operator of over 40 Skilled Nursing Facilities throughout 3 states was having liquidity issues due in large part to:

Significant debt service costs.

Rising labor costs (both skilled and unskilled).

Reliance on Agency Skilled Nursing labor (with no price caps) to meet state’s staffing ratios.

Significant inflationary cost increases to all necessary non-personnel costs (food, nursing supplies, geriatric supplies, etc.) - with Medicaid per-diem rates indexed to 2019 (i.e., did not account for any inflationary cost increases seen during and after pandemic)

Unprofitable facilities due to census caps imposed by the State due to IJ issues.

85% of census was Medicaid

Initial Steps:

Develop weekly cash flow for the facilities in the State where operator had most of its facilities to understand when and how much the cash deficit was to maintain patient safety, payroll of employees, etc.

Perform 4-wall analysis to understand the historical (trailing 12-month) for each facility to understand which were losing the most money. Categorized facilities into 3 buckets: 1) facilities losing >$1M per year; 2) facilities losing up to $1M per yer year; 3) profitable facilities.

Worked with management to understand the Category 2 facilities and the drivers of the losses to assess turnaround potential and realistic timeline for turnaround.

Meeting with State:

Met with senior members of the State’s Department of Social Services (jurisdiction over SNFs in the State) and Department of Health.

Provided a written and quantitative assessment of the facilities, how much was needed to remain solvent for the next 13-week period.

Proposed facility reductions based on 4-wall analysis, as well as non-financial considerations (i.e., access to care, facility quality, etc.)

Initial Outcome:

State provided a multi-million dollar advance to subsidize the company’s liquidity needs and provided a 2-month timeline to prepare a formal restructuring plan that it could evaluate, which needed to include reduction of beds, closure of facilities, and other patient care change initiatives to rebuild both financial and quality-of-care credibility with the two agencies that provided oversight.

Longer-Term Outcome:

Worked with outside restructuring counsel to prepare and make multiple revisions to restructuring plan that would ensure key facilities would remain open due to access-to-care, would enable financial sustainability in the long term and would meet certain bed reduction targets.

Transferred 5 facilities to a new operator relieving ~$500,000 of losses per month

Sold 5 facilities (both PropCo’s and OpCo’s) to investor and operator relieving another $1.2M per month of losses

Closed 2 facilities that lost a combined $9.8 million in the previous 12 months - both facilities were closed expeditiously while adhering to resident rights - one facility’s employees were all offered employment with the company at other locations; the other facility’s employees were offered employment on a needs-based criteria.

Keys to Success:

Worked hand-in-hand in-person with Executive Management. Management had never been a fan of consultants so having project leadership present everyday to interact and discuss matters with was instrumental in building trust.

Worked seamlessly with external restructuring counsel as the intermediary between the company and officials from the State to manage the restructuring process outside of a court-driven restructuring.

Engaged almost daily with the Company’s asset-based lender (lender on Accounts Receivable) to manage liquidity needs to maintain resident care needs and manage vendor concerns.

Redacted Sample Work Product

Weekly Cash Projection

Restructuring Plan Exec Summary

Facility Reduction Strategy